You’ll typically see this interest reflected in your monthly statements, and it becomes part of your principal for the next cycle of compounding. When it’s time to speak about Annual Share Yield (APY), think about it like a trusty magnifying glass specializing in the true incomes power of your investments or the true cost of your loans. APY doesn’t just glance at the fundamental rate of interest; it digs deeper, bearing in mind how often that interest is compounded – whether or not it’s day by day, month-to-month, or annually. When you’re weighing your choices between accounts with daily or monthly accrued curiosity, think of it as selecting between getting updates on your funding as every web page turns or simply at the finish of each chapter. Every Day accrual means your interest snowball gets slightly bigger with each sunrise—every.

Subparagraph (B)(ii) shall be utilized by substituting “$750,000 ($375,000” for “$1,000,000 ($500,000”. Clause (i) shall not apply with respect to any mortgage insurance coverage contracts issued before January 1, 2007. Accrued interest is an important concept to know when managing your finances. Whether Or Not you’re a seasoned investor or somebody just starting to explore the world of finance, having a clear understanding of accrued interest will empower you to make knowledgeable monetary selections. For the previous fifty two years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, marketing consultant, university teacher, and innovator in educating accounting on-line. He is the only author of all the materials on AccountingCoach.com.

Credit the Accrued Curiosity Payable account, which recognizes a liability for this unpaid curiosity. Reverse the entry when the interest is actually paid. Accrued curiosity refers to the amount of interest that has amassed on a debt or funding over time however hasn’t been paid out but. It issues because it impacts how much you’ll finally pay on what you borrow or earn in your investments.

- No deduction shall be allowed to the transferor or transferee beneath this chapter for any extra business curiosity resulting in a foundation improve beneath this subclause.

- The amount of any enterprise curiosity not allowed as a deduction for any taxable 12 months by purpose of paragraph (1) shall be handled as enterprise interest paid or accrued within the succeeding taxable yr.

- It is often primarily based on the time frame agreed upon by each events concerned in a mortgage or funding settlement.

- On the property side, if the company has lent cash or provided items or providers without quick fee, then accrued curiosity on outstanding loans or receivables is listed inside present property.

- The principal quantity is paid again to the bondholder at maturity.

If you have a daily curiosity loan, additionally called a simple curiosity mortgage, the cost due will always be the identical. A common interest settlement establishes a set rate of interest and normally a fee quantity that spans the time period of the loan. Accrued curiosity agreements have fees calculated primarily based on the current account balance and fee.

Accrued interest is a cornerstone of accurate financial planning. It ensures equity and accuracy in monetary transactions, particularly for bonds and loans. This financial concept is crucial for both debtors and lenders, because it ensures accurate accounting and transparent monetary reporting. It permits both parties to account for curiosity earned or owed in periods between funds. Accurately recording accrued interest in journal entries is crucial for maintaining clear and reliable monetary records.

As the top of the accounting period comes near, the borrower and lender should modify their ledger to account for the curiosity that accrued. Investment accounts deal with accrued curiosity with all the precision of a master chef measuring elements — every pinch matters. When you spend cash on one thing like a bond, the accrued curiosity accumulates between interest funds, simply ready to be added to the pot. However whenever you sell that bond earlier than the following curiosity fee is made, you have to pay the customer the interest that’s built up since you purchased it. Accrued interest, then again, is the buildup of that further earlier than it’s truly exchanged. It’s like bookmarking the interest you’ll owe or obtain on a particular date.

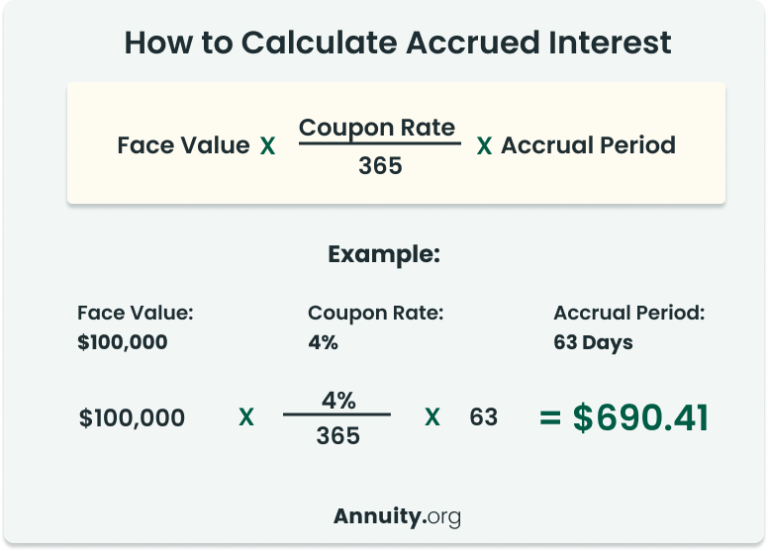

Tips On How To Calculate Accrued Curiosity

(II). (e)(3). 98–369, § 128(c), added par. (3) regarding special rule for authentic problem discount on obligation held by related foreign person. (3), regarding exceptions, redesignated (4). (h)(4)(C), (D).

Influence Of Accrued Interest On Bond Investors

![]()

If an organization incurs an expense, it needs to be recorded even if it hasn’t been paid yet. For simplicity, transactions typically take place on the ex-interest date – two enterprise days earlier than the coupon payment. Right Here, the bond is offered with out the right to the approaching coupon cost. Hence, no accrued curiosity is payable, and the buyer pays only the clean price. It avoids the complexity of prorated curiosity calculations and surprise prices for the customer. Nonetheless, investors should all the time concentrate on the impact of accrued curiosity on their whole value.

Company

It enables people to optimize debt payment strategies and make knowledgeable funding choices, thus instrumental in successful financial planning. Furthermore, curiosity accrued on financial savings or investment accounts can compound over time, resulting in increased wealth. Understanding how typically curiosity is compounded – whether daily, monthly, or annually, might help strategize one’s funding planning. Further, curiosity accrual can influence mortgage repayments considerably. Some loans, similar to pupil loans, may accrue curiosity whereas still in its grace period. It’s essential to make knowledgeable decisions concerning which loans to repay first, or allocate extra funds to, based mostly https://www.simple-accounting.org/ on their accrued interest.

Think About a enterprise that takes out a loan to purchase an organization automobile. The company owes the bank interest on the automobile on the first day of the next month. The firm has had use of the vehicle for the complete prior month and is therefore able to use the vehicle to conduct enterprise and generate income. For example, if the monthly interest due on a loan is $600 and the borrower pays only $500, $100 is added to the amount owed by the borrower. The $100 is the accrued curiosity.